Retail Executives Committee Q&A

Retail executives committee q&A

Question (1/15/21): We have quite a few employees that have exhausted their 80 hours of FFCRA pay. I would like to know how others are paying employees when they have to stay home for childcare or virtual learning for their children? Also, those indicating they have possibly been exposed to someone that has tested positive and need to quarantine. I am hearing some employers are having employees use their vacation and/or sick time.

Answers:

- We have the

- Same issue. We have a banked PTO bucket up to 2 weeks that they can have carried over from past years’ available PTO that they did not use. They can use that if they have it. If not, they have to use their regular Paid Time Off.

- We are continuing to pay the 80 hours for employees who have exhausted their time and are out due to exposure, testing, etc.

- Do you mean that once they have used up the 80 hours of FFCRA benefit you are just paying them their normal rate?

- Yes, if they are out due to exposure, testing, or are positive.

- Our associates are using PTO after exhausting FFCRA.

- We have made the decision to allow Market Leader/Area Manager “discretion” to pay teammates if they have exhausted Pandemic PTO time, regular PTO time, and rollover PTO time. This is case by case basis so leadership will and make decision to “manager paid time off”.

- We have pretty much been as flexible as possible with it as long as we feel the employee is not abusing it. We luckily have only run into a few cases where they have gone over 80.

- In mid-December, in anticipation of increased cases, I changed my staff back to a rotation – A and B teams rotating weeks with zero crossover of teams. When they are on rotation, they are paid as if they are at work. We use a special payroll code to indicate Rotation Schedule. These folks are essentially on call, so if Team A has an exposure or someone just calls in sick, Team A is out and Team B gets into the office. Office Leaders who are out on rotation work from home. If someone is quarantined due to COVID or exposure, they are also paid using a payroll code for Quarantine. We have paid our associates since March. I believe if someone chooses to travel to what we deem as a “high risk” area, internationally or a cruise for example, then we may ask them to quarantine upon return and that would be PTO. I have not had any of these situations yet in my market. We still ask our associates to log their upcoming travel in a secure portal that only HR sees when traveling outside their home state. To make it work, we had to temporarily close one office in Roanoke and disperse those 4 associates to other teams and 2 associates from our downtown office which does not have a drive-thru. By doing so, I was able to create two teams of 3 people at each location and 2 teams of 4 at my busiest office. Our downtown team was left with 3 and they work daily, of course there are several others of us in the building. My Lynchburg team is a team of 2 with 4 commercial staff in the same office, so they do not rotate either. They also do not have a drive-thru. So downtown and Lynchburg are by appointment only and night drop. All of my associates are universal bankers – transactions, accounts/maintenance and lending. We had a COVID situation in Lynchburg and were able to keep the office open by utilizing a Spoke Team B while that Spoke Team A kept their home office open in Roanoke. It has helped us really minimize branch closures the past 5 weeks. We are still very conservative and are still following the 14 days quarantine as well, not the revised 10 days by the CDC.

- We also have most of our staff working from home. For all employees we do pay 80 hours for FFCRA and if exhausted would have to use PTO.

- Our bank authorized an additional 2 weeks for FCCRA leave to be paid in 2021, once that is exhausted the employee will use their own time. If an employee is out due to exposure, we are covering that time as well at this point. If they get an alternate diagnosis after testing then they use their own time until they have been 72 hours without fever or symptoms.

Question (2/1/2021): I am in the process of standing up our online account opening offering for our customers. I am trying to predict account opening volumes the first year and continued volume as the as the OAO offering is adopted. The vendor is showing numbers that I find hard to believe for a community bank in the first year and going forward. Can any of you share approximate volumes and how long it has taken for adoption to occur? I am also appreciative of any other pointers/considerations you would be willing to share. Thanks for your time!

- We have had online opening for few years now. In the beginning the adoption rate was fairly low and year over year we saw 5-10% increase. Numbers jumped tremendously last year due to pandemic.

Question (3/5/2021): Does anyone allow the new acct rep to initiate an ACH debit for the customer at the time of new account opening? (i.e. from their old account at the other FI to their new account with you) If so, do you have transaction limits, procedures, etc that you would be willing to share? If not, because your FI has discussed it, can you share what made the team decide to pass?

- We do not currently. We were moving toward allowing the use of a debit/credit card to make their initial deposit. We worked closely with a vendor to create a custom account opening process and were going to incorporate debit/credit cards into the funding options since we were going to be able to open accounts in the office, at the client’s office, etc. The project stopped when we were acquired.

- No, we do not have that process as part of the new account opening. There are too many unknown factors and the risk is too high for fraud.

- We do not. We require an initial deposit to open the account and that does not include an ACH from another institution. We will provide them access to other apps where they can transfer funds (PopMoney for example) but we do not initiate an ACH. However, I wonder if we did offer an ACH debit process if that might eliminate some of our other concerns at account opening or create more.

Question (3/23/21): For those of you who have mobile deposit, what is your cutoff time for same day crediting.

- We use our end of day which is 5:00 Mon-Thu and 6:00 on Friday. Any mobile deposits made after 6 on Friday are deposited Monday morning.

- We also use end of day which is 5:00 p.m. all weekdays.

- Our cut-off is 4:30pm.

- Our cutoff time is 6 pm Mon-Fri.

- Our mobile cutoff time is 4 PM.

- We are 7pm

- Our cutoff time is 5:30pm.

Question (April 28, 2021): As more Virginia banks begin to reopen their branches, has anyone adjusted their professional dress guidelines/dress codes going forward? We had relaxed the dress code with skeleton staffing both in the back office and in the branches and are considering keeping it more relaxed going forward as well. I would love input from anyone regarding this.

- We reopened our branches in March. In retail, we have returned to professional dress Monday-Thursday with Friday being a day all our teams are wearing logo shirts and jeans. Our non-customer facing operations and administration employees are continuing with relaxed attire through the end of summer. With 14 months of jeans, business casual now seems like professional attire to me. We removed our tie requirement years ago, as well.

- We were already business casual M-Th and jeans/tennis shoes on Fridays. We went to jeans M-F while the lobby was closed, but now that we have reopened, we have gone back to the business casual M-Th and jeans just on Fridays. Haven’t worn a tie to work in 4 years!

- Beginning June 1st, officers will be business attire and non-officers will return to business casual.

- We got rid of ties for men and that was only change.

- We had also relaxed our dress code and have not made any adjustments as of yet. Will keep you informed if and when this changes.

- We are keeping with business casual with a “dress for your day” caveat that covers those days when “important” meetings require a more professional level of attire mainly for the management team.. Jeans are acceptable on Fridays.

- We have been back to our normal dress code since we re-opened Oct. 2020

- We continue to be business casual even after our doors are open. We do allow business casual with “jeans” on Fridays.

Question (5/10/2021): I am curious who in your bank owns the cash vault and courier relationship. Is it Retail? Finance? Another area? Or a combination of resources?

- Deposit operations (8 responses)

- Retail/Deposit Operations (4 responses)

- Retail (3 responses).

- It is a combination I believe of Finance and our ROOAs (Regional Office Operations Advisors). Our ROOAs assist the offices with all things related to deposit operations, office procedures and audit preparedness. They fall under the umbrella of Retail.

Question (5/28/2021): For those of you who

have or are deploying ITMs I have a few of questions:

1. Where are your ITM tellers located? Contact center,

branch, offsite? What other duties do they perform?

2. Are your ITMs located at branch locations or do you

have some deployed as stand alone?

3. And now for the ultimate open ended questions, what

discoveries did you make while implementing, what are things you

believe are critical to success and what “rabbit holes” are to be

avoided?

- We decided a few years ago not to do ITM’s but would be very interested to hear the relies and opinions of the others.

- We do not have ITMs and do not plan to install ITMs but would be interested in responses from others.

- We do not have them (7 responses).

- Our ATMs have ITM capabilities, however, we have not installed the ITM software as of yet. If we decide to upgrade it will most likely be in 2022 or 2023.

Question (6/10/2021): We’re in the process of updating our Dress Code Policy and would appreciate any current updates to policy that you have at your bank.

- It will be interesting to see what everyone has done since Covid. We have not changed our dress code on the retail side but did for non-customer facing employees as they can now wear jeans and a corporate shirt every day.

Question (8/6/2021): Due to recent events, is anyone considering making the vaccine mandatory or requiring everyone to wear masks regardless of vaccination status.

- We are now requiring all employees to wear masks regardless of vaccine status as of last Friday. We are not making the vaccine required…..yet.

- Vaccination has been mandatory since 05/15 for us. Only exceptions are bona fide religious or medical.

- Our bank is making you wear a mask if you are not vaccinated and it is optional for those that are vaccinated. Haven’t talked about making it mandatory yet. It is mandatory at our DC Branch.

- Mask are only required for those that are not vaccinated.

- We are still saying that vaccinated employees can go without a mask and the vaccination is not mandatory at this time. (5 others responded as same)

- We have allowed vaccinated teammates to go without mask if they prefer…We are now discussing with HR the possibility of going back and asking everyone to wear mask (no decision yet).

- We are asking all employees to wear a mask at this time.

- We are strongly encouraging the vaccine, but it is not mandatory. However, many meetings and events can only be attended by those who have voluntarily submitted their vaccination dates. Others can attend virtually. We are back to wearing masks for associates regardless of vaccination status and strongly encourage clients to wear them, but not mandatory yet.

Question (8/17/2021): Reaching out to see if any of you have a form that is used for an existing employee to post for an internal position. If so, are you willing to share? We do not currently have. I know in previous experiences the form included the following: Position posting for, why you feel you are qualified, and also required the supervisor’s signature.

- Ours is an online portal that has the following:

Name

Branch

Current position

How long at current position (require 1 year)Last performance rating

Performance counseling if any (written warning will stop the teammate from moving forward)

New job

Qualification for the new job

Current manager’s approval

Question (9/27/2021): If you’re willing to share - what time you are planning on closing on Christmas Eve and New Year’s Eve, as well as if you are planning on giving floating holidays for each of the holidays (Christmas and New Year’s Day) since they fall on a Saturday and do not impact all employees.

- We typically close at 12 Noon on Christmas Eve. We are open regular hours on New Year’s Eve. And we provide floating holiday leave when holidays fall on a Saturday and the floating leave must be used within 90 days. (2 responses with one being that they will extend the 90 day period based on staffing.)

- We will be closing at noon on Christmas Eve; 3:00 p.m. on New Year’s Eve; and giving a floating holiday for each of these days to be used from October 1, 2021 through March 31, 2022

Question (10/4/2021): We are currently in the process of reviewing our ATM and POS Limits for both consumers and businesses, and are trying to gather this information prior to making any changes. Please share if you can.

- Our POS limits are $3000 daily and ATM is $1010 daily for both business and consumer.

- Our current limits are:

- Personal $300 ATM $1,500 POS

- Business $300 ATM $2,500 POS

- $500 ATM, $2500 POS for both (2 responses)

- Standard limits for both: 800.00 ATM, 2,500 POS for both.

- Personal $400 ATM $1,500 POS; Business $0.00 ATM (unless request otherwise) 1500.00 POS

Question (10/4/2021): One of our bank’s initiatives for 2022 is to transition our Call Center to a Virtual Branch to include online account opening to start with. Reaching out to find out those of you that have a Call Center, and then put you in touch with Erin Paich, our Manager, so she can connect with each of your “Managers” individually or I also mentioned to her the idea of a “user group” of some kind that could meet/talk occasionally by phone to share best practices, helpful hints, etc, with regards to a Call Center / Virtual Branch. If this is something you feel your Call Center/Virtual Branch Manager could assist with, please let me know. Many thanks to Greg Hoover for connecting his Manager with Erin.

Question (1/3/2022): Are any of you considering closing lobbies again in the wake of the covid surge that is taking place?

- We sent a communication to our customers on Wednesday sharing that from time to time over the next few weeks their local branch may need to close their lobby for a few days. We asked them to consult our website, call, or check social media for updates. Right now we have 3 closed. I am sure it has hit you all just as hard. This is our plan for the moment and we may adapt if it becomes more widespread or more difficult to manage.

- We put the same communication out as above. (2

responses)

- 1) Right now, this is our plan but we continue to monitor. I can say, this one has impacted us more than when COVID originally started in 2020.

- 2) We did close one of our lobbies today (1/3) for coverage at busier branches

- We decided against closing our lobbies at this time and are monitoring the situation and in some cases running the branch drive up & lobby by appointment based on staffing at any given day.

- We are starting to see an increase in our offices as well. We

are doing drive thru at an office this morning due to Covid.

Another one that potentially will need to close to drive

thru. Are you all still doing a deep cleaning at

offices?

-

We have decided not to do a deep clean after a positive case as we clean with disinfectant after every customer.

-

Our cleaners have been doing additional cleaning and sanitizing at all locations since the pandemic began and will continue doing so for the foreseeable future as well as employees are cleaning in between customers.

-

- We haven’t decided to close lobbies at this point. We have been dealing with the growing number of cases/exposures on a case by case basis, closing lobbies and going appointment only where needed.

- We are closing our lobbies and going back to drive-thru an appointment only starting on Monday.

- We are modifying lobby service as needed.

- We have not decided to close lobbies as a whole but have closed lobbies on occasion due to COVID outbreaks or staffing shortages. We are starting to see an uptick in positive employees so that may change in the coming week. We also have decided not to do deep cleaning after a positive employee.

- We have not had to close lobbies at this point but have seen an increase in positive cases. (2 responses) We have been able to keep branches staffed with float staff but will need to take each situation on a case by case basis. There has not been any discussion to close lobbies. (2 responses)

- We have NOT closed lobbies. We have had to close 1 or 2 lobby locations in NC due to Covid related staffing issues, but kept the drive thru open. Masks are required once again for associates only if you are not by yourself in your office. We are also now following the new CDC guidelines, where we have been more conservative than CDC to this point.

- Like most everyone, we are letting customers in and encouraging them to make an appointment. (as long as we have the staffing to accommodate…). Cases were high last week and things were messy. Hoping that we will not see a repeat after the New Year’s celebrations. Our Pandemic Committee met and we are going to change our door signage from “Masks Strongly Recommended” to “Masks Required” (though we won’t refuse service to someone without a mask…the thought being that many who see the sign will go back to their car and get their mask…and we will have them available at the door.

Question (3/21/2022): Which banks still offer the medallion stamp program? We are having a lot of non-customers requesting a medallion stamp lately. We do not offer the service to non-customers. They are indicating that their bank no longer offers the medallion stamp, and they are referring them to a smaller bank or a broker. I called a couple of larger banks, and they no longer offer the service.

- We do still offer this service and only to bank clients. (14 responses)

- Larger banks that do investments do offer this service . All our branch managers have medallion stamp capabilities and this is very helpful for our clients.

- Clients only and at select offices in each of our markets. Three offices are geographically selected for convenience. My prior employer offered the service at every office, and we found that to be overkill.

Question (3/28/2022): We are looking at starting an Internship Program and I was hoping for some guidance from those of you that have them. I am part of the committee that is getting the program up and running and we have some questions. (below) If your Bank has an internship program, can you share some feedback or connect me with a leader of that program in your organization?

- How long they’ve had their program?

- What’s working / doesn’t work?

- Who runs it? HR, LOB, etc.?

- What projects do they have interns work on?

- What training do they have them do?

- How do they stay in touch?

There was quite a bit of feedback to this inquiry so you can find all of that here.

Question (3/30/2022): We are in the process of changing our facilities maintenance model to outsourcing the majority of our facilities maintenance. With this transition, we are going to hire a facilities manager to oversee all maintenance vendors, building projects, and possibly bank security. I was wondering if any of you have this type of position and would be willing to share a job description? I am also interested in the reporting structure of this position.

- Banks who have Facilities Manager position – 3 banks have this and can provide additional info if needed.

Question (4/12/2022): Out of curiosity, how do you handle getting information out to your teams. For example, policy/procedure changes specifically for Retail, operational updates etc.…? Also, what frequency do you conduct meetings with your team as a whole?

-

For operational updates, we keep an ops manual on the intranet that is updated regularly. An email is also sent out highlighting the changes and that the manual has been updated to reflect them. We only meet monthly as a group in person, but will have Teams calls to address things that might come up between meetings. We also get out to the branches more often to visit, address issues, answer questions, and keep everyone updated on things going on. (1 same response)

-

I have monthly meetings with all of Retail Management and invite other department heads. There are consistent subject matters that are covered every month. Our Director of Communications typically sends Bank-wide communications. It really depends on the subject matter though…I do occasionally just relay to direct managers to cover with their direct managers and so on.

-

Our Communications Team sends out a Friday Update email that will note anything of major importance with a brief description of changes and a link to a more detailed description that is housed on our intranet. Our ROOAs (Regional Operations Office Advisors) also sends an email of important reminders of changes to policies, procedures, audits, etc. She also is always part of my bi-weekly Zoom calls (1 hour) and in-person meetings. We were monthly, pre-COVID, but with the bi-weekly Zoom calls I implemented, I am doing in-person every other month currently for a full day. The full day meetings usually include our partners, ROOA, Group Banking (@Work) Advisor, Insurance, Investment, Merchant, Trust and Mortgage Advisors. The gaps in between meetings are filled in with in-person office visits and phone calls. Each region may run there’s slightly different.

-

We have a weekly email that goes out to managers to cover any news, events coming up that week, meetings, operational items, etc. If we do roll out a new procedure, we schedule at least 3 zoom session so that all branch staff has the opportunity to get on those calls and we also record these and save them to our internal drive for anyone that wants to rewatch it or missed it. We have quarterly training sessions with retail staff that are about 3 hours of training each, we hold 3 meetings so that most folks are able to attend.

Question (5/23/2022): Do any of your folks make physical photo copies of ID’s when opening new accounts? We currently have this in our policy but seems redundant since the info off the ID is captured.

-

We include images of the IDs in the client’s digital file. The images are typically provided by the client and provided via email or through our online account opening portal. The image from the ID is used in a virtual verification system as part pf the online opening process and provides tellers with confidence that the individual transacting business with them is in-fact the person they purport to be. And, as we grow, it’s an increasingly important part of our KYC.

-

Yes, we copy and scan the IDs into Jack Henry Silverlake so it appears on the client’s CIF record when the Financial Specialist accesses the account. (5 responses – 1 response for FIS)

-

We capture the information in our core at account opening but do not make a physical copy of the ID. (7 responses)

-

We enter the information into the system and scan or copy the ID.

Question: 6/1/2022: We currently use centralized account opening and are researching the possibility of taking that process back into the branches. I have a few questions if any of you all have any insight on what your bank has been doing and what is working for you in this area:

What core are you currently using? FIS (1); Fiserv Premier

(1); Jack Henry – ARGO for account opening and Andera for online.

Andera is getting ready to sunset. We are moving to Jack Henry’s

OpenAnywhere for online and for our first Digital Office opening

in Q3 in Nashville at Amazon. We anticipate this will eventually

replace ARGO as well. (1) Fiserv Signature (currently doing due

diligence for a new core) (1); FIS Bankway (2); Jack Henry

(1); JHA-Silverlake with OnBoard for account opening

(1)

Is your account opening in the branches or

centralized? In branches (6); In offices

(1); Currently we are switching to NCino from On-board. So

much will be much faster than we’ve been in the past… less than

10 minutes. Target completion mid-July. (1); Centralized

(1)

How long does the entire process typically take? 15 min

(3); Using ARGO about 5 minutes for an existing client; new

client, maybe 10 minutes. Obviously, conversations to identify

needs, offer solutions, etc. adds time to the process. (1); 5 min

consumer, 25 business (1); 15 -20 minutes (1); less than 10

minutes for existing consumer and business customers, 15 minutes

for non-customer new account. New business accounts take longer

depending on the number of signers and profiles that have to be

built prior to the new account opening. I would say 30 minutes

max. (1)

How does your back office file documents, DL, and post CDD-ADD

risk rating on the BSA side? Image Centre (2); Our

Financial Specialists (FS) and Office Leaders (OL) scan and

upload the documents themselves into Synergy. Deposit Ops reviews

everything and identifies any exceptions.

(1); All documents are imaged and stored

directly to our core ‘director’ is the name of file

system. (1); Nautilus (1); CDD questions are asked by

the CSR and are entered into the core. We use e-sign and image

the docs directly via that method when possible. If e-sign is not

possible, we print and image. (1); Synergy, Yellow Hammer

(1); all docs go in Synergy, eSign docs (new/maintenanced

account docs only) are auto imported to Synergy, supporting docs,

ID, etc are filed in Synergy by Account Centralization

Specialist. BSA uses Verafin for all risk rating assessments

and information is housed in Verafin. (1)

Do you set the customer up for OLB or do they self

enroll? Self enroll (6); we assist but they may also

self-enroll (1); Self but willing to assist in branch,

online, etc…

Do you have a lot of exceptions and is that impacting the

customer experience to have to correct documents? No

(3); Since we started having our frontline associates scan

and upload their own documents and usually a second set of eyes

in the office as well, then Deposit Ops doing the official

review, exceptions have been minimal. Our Regional Operations

Office Advisor also monitors exceptions once they hit 15 days on

the exception list and stays on top of the FSs or OLs to get it

resolved timely to avoid account closure at 30 days.(1) Not a lot

but more than I’d like (1); There are exceptions

particularly relating to CIP as we will allow businesses 30 days

to clear. As well there will be the typical human error;

however, limited number.(1) Not in my opinion (1); we have

no exceptions, that is mitigated upfront in the account process.

(1)

How do you train your staff to open accounts? In

person training for at least four days – followed by in-person

mentoring for one to two weeks. (1); We only hire

experienced associates with 5 years minimum and all of my

associates in VA are Universal Bankers. So they already know the

basics, Regs, etc. So after Transaction Processing training, they

usually go through our 2 day training to learn our system and

procedures for account opening within 1-2 months of hire date.

They then work with another FS or OL in the office to review

their work for a period of time, depending on

experience.(1); In Person and Mentoring for 2 weeks (1); 3

days course work and 2 weeks OJT with a mentor (1); Trained and

mentored in the branches (1); CSR will come into the

classroom for 3-4 days with our trainer then sent to the branch

with a “buddy” for 3-4 weeks. (1); Week in class, immersion

experience typically in heavy traffic branches with training

partner or Subject Matters Expert (1); They are trained in

our busiest branches for two weeks. (1)

Question: 6/3/2022 - As we are working to get back to a real “new” normal, I am interested in looking at engaging sales training consultants to assist with a reboot of our sales processes. If any of you have any suggestions as to groups to contact, I would greatly appreciate any input you are willing to share!

-

We used Mark Faircloth just before COVID, he did a great job. I also have been through the Omega training a few times, including being certified as an instructor. I do think whatever program you use, you need to have someone internal taught to train for future hires and refresher for existing staff.

-

We are currently using Anthony Cole training with Jack Kasel. He has calls with different groups of employees including our commercial team and he comes in person for half day sessions about once/quarter.

-

We work with Paul Nunn at Pinnacle Financial Strategies. They also handle our secret shop program and Manager coaching training due to the obvious relationship with all 3. We’ll be doing an updated sales training later this year so I’ll have a much better point of reference as we build that out.

Question: 6/6/2022 - Where are your loan payments (particularly those that may be coming to a PO Box ) processed at your respective banks?

-

Mail in deposits are posted at a branch we have designated for the PO Box payments, loan operations handle payments through our website, and obviously payments in person are processed at all branches.

-

The branch located in the corporate office of the Bank processes all mailed loan payments. (3)

-

Unless the payment is mailed to a specific branch, all payments are processed at our corporate office.

-

We process our mail in payments in our Loan Operations department (back office) have been doing this for 20 plus years with no issues. It is all dual control and monitored as well.

-

Mail in payments sent to corporate are handled by one individual, payments mailed to branches are logged as dual control on the night drop log as incoming mail, our dealer department is handled over the phone or over a payment portal.

Question: 6/13/22 - With so many in the workforce telecommuting we are looking for a way to help those required to be in the office every day offset the ever increasing cost of gas. Have any of you contemplated this yet? If so can you share what you’re are doing as well as how much and how you are paying them? We’re considering gas cards, incentive dollars and adding to their paycheck. I am not in favor of the latter as it looks bad if/when we take it away.

-

We are in the process of purchasing 100.00 gas gift cards for the team. Buying several different cards due to proximity in certain branch locations. We will monitor the “if and when” for the next round if needed. We plan to physically deliver the cards.

-

We are considering gas cards. Agree with you on not adding to the pay. Too difficult to pull it back. Will keep you posted.

-

We gave gift cards to all employees with $500.00. Not sure if we will give more later or not.

-

It’s definitely a topic of discussion over here but we have not done anything as of yet. Really like the gas card idea! (2 responses)

-

One of associates in NC is putting together some education around tips to save on gas, including using some gas apps. Upside and GasBuddy are two that he mentioned. We have not considered a mass distribution of gas cards at this point. However, when we do an associate WOW or associate recognition, we are primarily using Kroger gift cards in the Roanoke area so folks can use it for food or gas.

Question: 6/28/22 - Our Branch Ops Manager is working on updating our Business Continuity Plan. One of the items she is trying to get a handle on is what a reasonable offline check cashing limit might be. I thought it would be worth an ask of this group, if you are able to share what limits might be in your institutions.

- We don’t have a policy but try to keep it at $200 unless we know the customer and feel comfortable with more.

- We use $500 as our offline check cashing amount.

Question: 7/1/2022 – We are beginning to have

some dialogue regarding changes in our industry regarding

overdrafts. I’m interested in what posture other community banks

might be taking. Below are a few questions:

Is anyone eliminating OD and NSF fees?

How are you handling re-presentment items/transactions?

If you still have OD/NSF fees, have you gone to a once-a-day fee

instead of a per item basis?

Is anyone counseling overdrafters with large fees?

If you have gone to not allowing overdrafts, how are

customers reacting to that change?

- This is so timely. Thank you for getting the conversation started. For some time, we have had in place a maximum number of fees per day as well as we pay all items $10 and under.

- We are changing our program in several aspects. I’ll share more next week.

- This is on our radar as well and we are in initial conversations. We have the Bank On product that we’ve white labeled as our “Pathway” account. Great solution for serving the unbanked. Happy to answer questions you have there.

- We introduced a new Checking product as well as reduced the # of fees that could be assessed.

- I agree, very timely to get the conversation started. We have not yet adjusted anything to our overdraft program. We just completed an OCC exam recently and the regulators didn’t really have a lot to say in regards to overdraft during this exam. We are looking at our de minimis and increasing that possibly and obviously being cautious about the NSF fee going forward.

- Effective August 1, here’s what’s we’re doing:

-We’re eliminating Non-sufficient Funds (NSF) Returned Item fees for consumer clients and lowering them from $38 to $30 for business clients.

-We’re lowering Overdraft Paid Item fees from $38 to $30 for all clients.

-We’re introducing an overdraft cushion of $15 for consumer clients.

-For consumer clients, we’re reducing the maximum number of Overdraft Paid Item fees from five per day to three.

Question: 7/14/2022 - Reaching out to see if any of you open CDs through your online account opening channel. If so, please let me know as we are considering.

-

As soon as we get ours up and running, we will be able to establish CDs via Online Account Opening.

-

We did not include CDs for either consumer or commercial clients in our online solution.

-

Yes, we allow customers to open CDs via our online channel. (4 responses)

-

We initially only set up online account opening with DDAs and Savings accounts. We are now in the process of setting CDs up as well.

Question: 7/22/2022 – Have any of you worked with vendors who provide small business relationship development training to branch managers and small business calling officers that you would recommend or are aware of? Also, for business deposit accounts, have you built your accounts internally or do you use a specific vendor for these products?

-

I have not worked with anyone while here at my bank, however, at my previous bank we used St Meyer and Hubbard for business banker sales training. It has been a while, however, I would think they still do today. Have always built our business deposit products internally at any bank I have worked. (1) We are much the same and have used Hubbard as well as some of our internal talent. We, also, craft our own business deposit products.

-

We have not hired anyone to train our teammates recently. We use e-mentor and Vertical IQ as well as internal training. Our products/services have been developed internally. We have developed our own internal training and are relaunching an updated version this fall. We also use D&B Hoovers, Vertical IQ and IBISWorld. We develop our own internal products.

Question: 8/11/2022 - We are considering shuttering branches on Saturdays; I know Abbie said they had done the same. Is there anyone considering or already closed on Saturdays?

-

We do not have Saturday hours at any of our locations. I was at a Bank of America near my home the other day and noticed they don’t have them either. Seems that many banks took the opportunity to reevaluate hours in the post-pandemic environment. Digital banking gives clients access to so much now it’s hard to justify the expense of opening for just a handful – at best – of transactions.

-

We are not considering closing on Saturdays for all branches, however, continually monitor activity and do have 1 office closed on Saturday and several drive-through only.

-

We have closed branches on Saturdays. The volume didn’t justify.

-

We’ve done a mix depending on the customer traffic in the market. Richmond Region: No Saturday Hours; Williamsburg Region: 1 Branch Open Drive thru only with shared staff from the region 9-12; Middle Peninsula Region: all three branches drive thru only 9-12; Northern Neck Region: 1 branch fully open with shared staff from region 9-12

-

Not all of our branches are open on Saturday, we have approx. ½ that are open and we will continue to stay open due to heavy transaction volume

-

As we have opened new locations, we have steered away from Saturday hours; however, in more of our legacy footprints, Saturday drive thru hours remain realizably strong. We continue to evaluate altering hours in some of our markets as transaction counts decline but do not have any plans to alter hours in the immediate future.

-

We have operated for many years as drive-through only on Saturday. We did make the decision as we opened new branches in NC to forego Saturday hours there. Always easier to never start with them. However, in our VA markets we still see a good number of transactions most Saturdays. We have no plans on the immediate horizon to change.

-

We do still have Saturday hours except for our newer market where we are less established and only have one branch open to cover that part of our footprint. We have talked about closing on Saturdays and are monitoring traffic but have not made any decisions at this time.

-

We are NOT open on Saturdays in VA, NC, SC, GA and AL. We are open 9-5 M-F. I believe there are 6 offices in TN that still have limited Saturday hours.

Question: 8/15/2022 - For those of you who have Call Centers/Customer Contact Centers, do you all have employees on call to answer inquiries that come in via email, or via secure messaging on your online banking over the weekend? If so, how do you compensate them for coverage. Here at [my bank], we do not respond to customers between noon on Saturday and 8:00 a.m. on Monday mornings, so looking to see what some of you may do with regards to client service during those hours.

- We do not have service on weekends currently. I’m interested in this as well. (2 responses)

- We have service with our call center until 4 on Saturdays, nothing after that.

Question: 8/29/2022 - Do your lenders make site visits to take photos of homes being used for collateral or do you use another means such as satellite photos? Currently, our lenders make site visits which I find to be an inefficient use of time.

-

Typically for 1-4 residential properties, if an appraisal is ordered, the appraiser includes photos. Vendors are used in other situations. (2 responses)

-

Typically, a new appraisal or desktop evaluation will be ordered from a vendor. However, should the appraisal being utilized with the loan request be newer in scope (just a few years age or less), we will ask the loan officer to drive to the property and take a photo.

-

We use a drive by evaluation from a third party company for any HELOCs under $250k. If they are over this amount, we require a full appraisal. (2 responses)

-

We use third party for the evaluations.

-

With all new 1-4 properties we use the photos submitted by appraisal. We do perform on site visits/photos for our construction loans. (5 responses)

-

We do order an appraisal or evaluation with a new loan request; however, we are required to do a site visit to the property before we request an appraisal/eval. We also have a form to complete confirming that we did so. Same thing for renewals/modifications where an appraisal/eval is already in place.

Question: 9/13/2022 - For those of you who have Saturday hours, will you be open on Saturday, December 24th and Saturday, December 31st?

- Open from 9am-12pm both days (2 responses)

- Closed Christmas Eve and open normal hours on New Year’s Eve

- Closed both - (3 responses)

Question: 9/14/2022 - Our bank is looking at our staffing model and our retail strategy. To make this a more general question and based off of branch deposit levels, what would you say are your branch FTE’s for branches that are under $75 Million and also over? What are the staff titles in the branches?

-

We go 3 to 4 in most of our branches, we look at teller transaction and account openings to determine which one. We probably are a little heavier staffed at the moment with 4 in most of those branches, people seem to be out more than they used to, plus our turnover rate is higher. For over $75, we are 5 or 6, again based on transaction volume and account openings. I am looking at UKG, which offers a staffing model based on activity (used to be FMSI’s model, which I used at TFB but with some serious upgrades). We use universal bankers, we call them relationship bankers.

-

We typically have 3 in each branch though with a primarily commercial client base we don’t see a lot of foot traffic. We have a few floaters that help fill the gap for vacations and sick days. Our larger volume locations have 3 people with floaters as needed.

-

I have 3-7 (most are 4-5) in each office based on transaction count, account opening/maintenance, loans, etc. I only have one office with 3, due to space (converted from LPO to a functional branch). We will be building a new office for them over the next 6-9 months and will increase them to 4. I have 1 rover and pull from other offices as needed to fill in. We are a flat organization with 2 positions: Office Leaders (mangers) and Financial Specialists (universal bankers: transaction processing, account opening and loans). We do not have levels either like FS I, II, III, etc. We also do not place emphasis on titles. All OLs for example are SVPs, same as me. There is no incentive or increases tied to titles.

-

We base our staffing on branch activities (transactions, new accounts, account servicing, hours of operation…) For full service offices, we have a 3 FTE minimum.

Question: 1/25/2023 - Reaching out on Incentive Programs for branches. We have one and are looking to make some tweaks and have a few questions:

- Is your payout quarterly, annually or do you do both of some

kind?

Response: We have a quarterly payout for all branch teammates including branch manager. We also have an annual incentive for Branch Managers. Our Market Leaders are on an annual incentive. - Is your payout a certain percentage of salary or just a flat

amount for all in a particular position? For example, all

Branch Managers who make their goal at 100% get $4,000?

Response: Flat fee per category for the quarterly incentive for 100% – Annual is a flat dollar based on performance level. - Do you have individual or team goals, or both?

Both – 1 response - Key Performance Indicators? Currently, we center ours

around Loans and Deposits. Any others you all may

include?

Response: Loan production, loan balance sheet growth, new money deposit, deposit balance sheet growth, new checking account, client relationship development which is similar to cross sell - Do all goals have to be met before you payout or do you have

a threshold of paying out. For example, if they reach 85%

of the goal, 50% of the incentive is paid out?

Response: No payout under 100%, 3 categories must be met at 100% . - Any added incentive for the top branch ?

Response: that is the annual portion that is for Branch Managers and Market Leaders

Response: Our incentive payout works a little differently and is firmwide, not segmented by retail, commercial, support roles, etc. I’ll do my best to explain without divulging too much info.

ALL non-commissioned associates participate in the incentive payout. We are simply a win together lose-together model. Incentives are paid out based on a percentage of their income. There are key metrics that we must make as a firm to achieve an incentive payout: EPS and revenue. We have a goal to reach 100% payout (and we have paid out less than meeting 100% at a reduced percentage). We also have a stretch goal that if we make that goal, we pay out 125% of the incentive payout. The incentive is paid out annually in January for the prior year. It is pro-rated based on the time you worked within that year, so even someone hired in say November will get an incentive payout. Associates may opt to do the 401K match as part of their cash incentive payout. In addition to a cash payout, we are also given restricted shares as an additional grant payout, so all our associates are shareholders of [the bank].

A couple of things can reduce or eliminate the incentive payout.

- A phishing violation (real or internal failed test email) – percentage reduction in incentive payout up to a maximum dollar amount

- Values Assessment (performance evaluation) – percentage reduction if Needs Improvement rating and no incentive for an Unsatisfactory rating

We use a KPI report to track goals to performance; used as a tool (not carrot/stick mentality). Each commercial FA and OL has their own KPI. Everything in the offices is coded to the OL, so it is a branch office goal. We focus on deposit and loan spread revenue and fee income. Fee income for the offices includes partner referrals (mortgage, trust, insurance, merchant, and investment – commercial FAs have a few additional categories) and then Other Fee Income (other loan fees, other deposit fees, account analysis/treasury fees and interchange fee income).

Question: 3/6/2023 - Is anyone currently using a Mystery Shop program? If yes, are they someone you would recommend?

-

We currently do not use a mystery shop program, but would be very interested in feedback from the group regarding recommendations. (2 responses)

-

We use Pinnacle for our program. I’m happy to chat with anyone about our positive experience. (2 responses)

-

We use Voice of the Customer, which is through CS profiles / Clarke American. (2 responses)

-

We have used Chris DiLorenzo with James Paul Group for several years now. I believe since 2014. The style of reporting is fantastic. I am happy to share contact information.

-

We did with Bancvue when we had Kasasa but do not currently have a mystery shop program

Question: 3/6/2023 - We are in the midst of formally structuring a Treasury Services Department. In the past we have had a variety of job functions involved throughout our operations team, a business development officer, our branch CSR team and even our business bankers. As you can see, it was wide spread involvement. As we look establish a center of expertise and to define job descriptions, I reach out to each of you asking if you would be willing to share your job description for:

- Treasury Services Officer (product/service sales officer) or similar title

- Treasury Services Specialists or similar titles: operations focused roles and customer support roles

- Other?

We just posted a position

Question: 4/6/2023 - Do any of you offer this for your clients? We are considering but want to talk to some other Virginia banks about their experience.

Yes, we use them – 11 responses

IntraFi Network is a VBA Endorsed Provider

Contact: Patrick Kealey, Managing Director

1300 N. 17th Street, Suite 1800

Arlington, VA 22209

Phone: (866) 776-6426 x 3468

pkealey@promnetwork.com

https://www.intrafi.com/

Question: 4/13/2023 - I was wondering who you all used for security training for your banks, specifically Active Shooter training? I know at VBA Connect we had a great presentation from Blue U, but wanted to reach out and see what everyone was doing and using.

-

We are currently evaluating this as well due to the recent school shooting in Nashville near our headquarters, in Louisville near a new office we are opening and then the hostage situation at Wells in NOVA. I’ll let you know who we plan to use once decided. I did send our Security Officer the contact for Blue-U Defense as an option. (3 responses)

-

All new hires view an Active Shooter video during their first week and the topic is discussed to include the placement of intruder barricade door systems, first aid stations, AEDs, and bleeding control kits. The in-depth training is done in house and was dormant during COVID, however was scheduled to re-launch this Spring. Given recent events, the re-launch is even more of a focus.

-

We have normal quarterly training but not detailed as it probably should be.

-

We have a 6 minute video we show all new hires called Run-Hide-Fight- Surviving an Active Shooter Attack. I concur, in light of recent events, we should make this a part of an upcoming staff meeting for all.

-

I’ve incorporated this in to our training sessions: https://youtu.be/TeOdxKozra0

-

Last year we partnered with the Virginia State Police to conduct active shooter training. There is no charge for the training as they do it as a community service. Our security officer reached out to someone locally at the VSP. I thought the training was excellent and heard positive feedback from others. (3 responses)

Question: 4/25/2023 - Question on Crypto and Wire Requests: I have a question for the group regarding crypto currency and outgoing wire requests. We are experiencing an increasing amount of outgoing wire requests in which customers are sending money strictly for crypto investments. With some of these transactions we have uncovered fraud potential and luckily saved customers from losing a large amount of money. As of late, we have noticed the amounts are getting larger, $100K+. Does anyone have a set limit or policy that you use when determining your stance on wiring money for crypto purposes?

-

We have had wires sent for crypto in the past and we don’t set limits. We advise the customer of the potential risks when we know it’s for crypto but sometimes it’s not easy to determine what the customer is really up to if they don’t share that they are purchasing crypto.

-

We do not have any dollar limitations on crypto currency purchases via wire transfer. We will also educate the customer regarding the risks, but do not stop a transaction unless we believe it to be fraud. Our BSA department does scrutinize these transactions closely on the back end and we reserve the right of course to limit these transactions or close accounts if warranted. (2 responses)

-

Yes, we have done several wires to “crypto” recipients. I wouldn’t say we have a policy but we scrutinize them more than your average wire. We have on occasion refused to send wires when we know the customer is part of a scam. Usually the average amount being sent is less than $5K. I know that we refused a $70k wire sometime ago and we got a thank you call from the son of the woman saying she was definitely being scammed and was grateful we refused to send the wire. We look at the age of the originator, average balances, other money movement, if we get a whiff of anything we start asking questions and if the customer is unwilling or hesitating answering we typically will decline to do the wire. I wouldn’t say this process is just exclusive to “crypto” recipients.

Question: 5/5/2023 - Reaching out to see if any of you currently charge annual fees on: Consumer lines of credit, and if so, how much? Home Equity Lines of Credit, and if so, how much? Understand you may or may not be able to share both, however, open to hearing anything you can share regarding these questions.

-

We do not have an annual fee on either (7 responses)

Question: 7/11/2023 - Do any of you operate a branch with modified(shorter hours) or a branch with 2.5 FTE or less? If you do, I have some questions about a situation I am dealing with and would love to chat.

-

The minimum we have is 3 in branch, no modified hours.

-

Our min. is 4 but we can run with 3- normal hours (2 responses)

-

We have 4 FTE approved but can open with 3. (2 responses)

-

I have a couple of locations that typically operate with 2.0 or 2.5 FTEs.

-

I have a branch in the Northern Neck that runs on 2 people with shortened hours.

-

Our minimum is 3; however, in some of our more rural areas I have operated with two on occasion. These branches doe have slightly different operating hours as well.

-

Our minimum is three.

Question: 9/29/2023 – Our bank is considering adding a small float team staff. For those of you that already have this in place I am looking for ideas… (responses below are in parenthesis)

- How many hours are they set to work/week?

most are full time (3)

40 hours/week (2) - Do they get paid a higher rate? Or mileage?

mileage (1)

no special hourly rate; home office is established and mileage is paid from home office to different office unless different office is closer to where they live than home office (1)

one year of service we add $1/hr stipend; also pay mileage for all miles incurred over 15 each way (1)

they get paid the same hourly rate and also get mileage (1)

rate is typically the same as other similar employees; they do get mileage which adds up quickly (1) - What do you call them?

branch support (1)

Rovers – Roving Relationship Teller or Rover CSR or Roving Relationship Banker (1)

all are called Financial Specialists and are all universal bankers (transaction processing, accounting opening and lending – we have centralized underwriting); floaters are Financial Specialist Rovers (1)

floater (2) - Are they tellers or Universal employees?

mix of Tellers, CSR and Branch Support; newer Tellers will be cross trained up as they learn (1)

both (2) - Who manages them?

Branch Ops Manager (1)

It’s divided into 3 leaders based on the rover’s role (1)

They are assigned to one of our Office Leaders (managers) where their home office is located (1)

we assign them to a particular branch so that br. manager will be responsible for training/development/coaching as well as making the weekly schedule for the floater to go to different branches (1)

they are assigned “home” branches for training and accountability; we look to each of hte other managers for input for reviews (1) - Do they get incentives?

not currently (1)

none (1)

yes, we have a “win together, lost together” incentive program; if the firm makes its goals, every non-commissioned paid associate earns their incentive paid in January and it is a percentage of their income (1)

they get incentive when the Market they are working in achieves its goals (1)

floaters are eligible for monthly referral incentives (based on dollars deposited) and their annual incentive includes both overall bank growth and growth of their home branch (1)

We have a floater team. I have 2 Full Time Floating Supervisors that are full time, they float amongst 12 branches. These floaters can function as the Manager or Universal Banker. We do not do incentive. They are paid on the same scale as an Assistant Branch Manager and they do receive mileage if they travel past their home branch, which is normally the closest branch to their home.

We only hire experienced associates – Financial Specialists require 5 years min.

Question: 10/17/2023 - Reaching out to see if any of your banks have done research on the cost to mail a paper statement versus sending electronically. I know there can be some variables, however, just trying to get an estimate. About 7 years ago or so [at my old bank], we used $2.00 versus 0.14 cents.

-

We have not completed any recent analysis on this but $2.5 to $3 is about right.

Question: 11/14/2023 - Have any of you seen a fraudster go out and modify or create current SCC docs and come in with altered docs to open a commercial account. We recently experienced this, and it is a new one for me. It also seems he is using a stolen identity to do so.

-

We had this happen with North Carolina Secretary of State documents, I’m happy to discuss.

Question: 12/7/2023 - We have seen an uptick in employees with vibrantly dyed hair and facial piercings. Reaching out to see if any of you are experiencing the same and if so, have you put any policies in place around them?

-

We have fortunately not run into the vibrant hair dying scenario very often but have absolutely faced facial piercings.

We have a done a few things to our handbook in reference to dress code. We keep the following statement in our handbook, and I think this would cover the discussion around vibrant hair dying: “Employee appearance should be clean, neat, and professionally appropriate at all times. Extremes of any style are not permitted.” We also have the following listed specifically for “Hair Styles:” – “Hair styles should be in keeping with business attire. Radical, high- trend, ultra- casual and unkempt styles are to be avoided.”

-

We do address hair and facial piercings in our Personnel Handbook. Here are a couple snippets of what we have in policy:

No employee may report to work with pierced eyelids, nose, lips, tongues or other body part except as mentioned above;

Hair Styles – Hair styles should be in keeping with business attire. Radical, high- trend, ultra- casual and unkempt styles are to be avoided

Question: 12/7/2023 – PTO for Branch Employees: For those Banks who continue to have Remote/Hybrid employees, do the branch employees receive any additional PTO. For example, if I am working remote today and feel under the weather, I may choose to work and not take PTO, where a branch employee would have to take PTO. Trying to determine how to be fair about leave for those without the option to work from home. Any and all feedback is appreciated.

-

We do not have a specific policy addressing this and give PTO equally at this point (7 responses)

-

We do offer 3 additional days of PTO to our retail/non-remote employees. We do not have fully remote employees, so all of our remote capable staff are considered hybrid. They are not awarded the extra 3 days of PTO.

-

Following as we are looking to update our policy here at the Bank…. We very conservative and looking to relax it a bit!

-

I have had the same conversation regarding the remote work team’s ability to work from home when not feeling well, however, those that are customer facing don’t have that option. Are your remote workers required in office a certain number of days? One of the thoughts we had was if you are required in 2 days a week and you can’t come in on your scheduled days, then possibly you have to make it up by coming in another day.

-

We do not have hybrid associates, except in one area. Our Client Service Center (call center) associates are the only ones who have a hybrid schedule and they did pre-COVID. They can work from home 3 days a week, but must be in the office a minimum of two days. With this group, we can monitor all of their call activity, listen to calls, etc., so we know they are working. We ask them to come into the office for teambuilding purposes and synergy. Because the call centers are [located in other states] I do not have to worry about associates wanting to go work for CSC in my area, because they could not travel to meet the two days a week in the call center criteria.

Question: 12/8/2023 - Do you have a teller outage policy? What amount are you having it go up a level to sign off on?

- We have a policy now that any outage $100 or over has 2 people check off on looking for the outage and it gets sent to area manager to sign off on. $1000 outage and the branch needs to be audited. I’m wondering if we can increase that amount to $500 or if other banks have a specific policy.

- Ours is like yours over $100, it gets sent to Retail Leader and Security.

- $100 is the threshold.

- Anything over $50.00 has to be reported to the Chief Banking Officer, and the teller is placed on probation if over $100.00.

- $100 or greater requires an Officer audit the drawer and Branch Manager is notified. $500 or greater requires an Officer audit the drawer and Branch and Regional Managers are notified. (If the outage is not located w/in 5 business days HR is contacted)

- Here is a quick summary of ours…Keep in mind the Counseling

Action form may be used at any time at varying levels of severity

(verbal, written, final), up to and including termination, based

on amount, situation, patterns, etc. My ROOA (Regional Office

Operations Advisor) and I make that decision based on guidance in

conjunction with HR, as needed.

<$5

Associate confirms accuracy of cash count, processes over/short.

Multiple small outages or pattern in 30-day period, are looked at further by Office Leader.

$5-$49.99

Performs activities outlined within the Out of Balance Checklist.

Notifies Office Leader, if unresolved.

$50-$499.99

Performs activities outlined within the Out of Balance Checklist.

Another associate completes full new recount.

Notifies Office Leader and Regional Office Operations Advisor, if unresolved.

Notify Finance Specialists who may detect error or offset next morning in reconciliation process.

$500-$1,999.99

Performs activities outlined within the Out of Balance Checklist.

Another associate completes full new recount.

Notifies Office Leader, Regional Office Operations Advisor and Security Officer, if unresolved.

Notify Finance Specialists who may detect error or offset next morning in reconciliation process.

$2,000+

Performs activities outlined within the Out of Balance Checklist.

All associates and vault are audited.

Notifies Office Leader, Regional Office Operations Advisor and Security Officer, if unresolved.

Notify Finance Specialists who may detect error or offset next morning in reconciliation process.

Question: 12/29/2023 - We are researching the offering of BankOn Accounts. Reaching out to see which of your banks have BankOn accounts and if you do, do you feel it has driven in depositors.

- We do not offer BankOn Accounts, but I am interested in learning more from participating banks. (6 responses)

-

We did when [I was with another bank] and participated in proving financial literacy training. We did not see much in the way of results and turnout for training was minimal for our market. We had a couple of companies that took advantage of the payroll cards we offered.

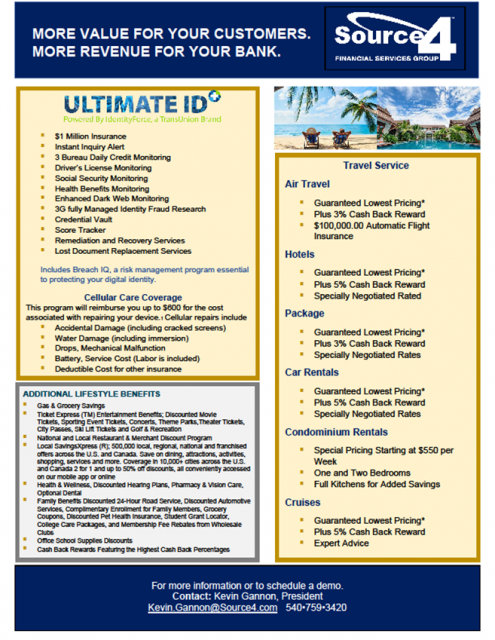

Question: 1/11/2024 - We had a presentation with Source4 yesterday regarding their partner program, GenGold. I am curious of the following:

- Who uses GenGold?

- Amy, what endorsed solution does the VBA have. Perhaps this?

- Do any of you offer something like GenGold but not this specific product?

Here is an example of what they offer:

Responses:

Do not use but would like to learn more – 7 responses

My old bank used them but ended the relationship due to a merger;

happy to answer any questions – 1 response

Question: 1/22/2024 - Reaching to see what you all may be doing with regards to bilingual programs? We are trying to figure out what is the best way to move forward with those employees who are willing to translate for customers while also staying in the lines of regulations.

- We do not have a formal program. We have several bilingual employees on staff throughout the bank and they are called on, as needed, to assist with translations. They are not compensated separately for this function. 3 responses

- We do not have a formal program – 5 responses (Our bilingual associates help translate when needed for customer interaction.)

-

Same, nothing formal and we have not translated documents to other languages. Our Client Services Center (CSC- 24/7 call center) does have a formal external resource they can use for translation services for CSC calls only.

-

We haven’t made the commitment to translate everything. We do however have a number of bilingual employees who are available to help translate in one-off situations.

Question: 2/1/2024 - We are mid-way through the implementation of an AI based fraud reduction solution and are currently performing a manual review of all large dollar checks presented through in clearing. This is a tedious process and unfortunately one that is fraught with opportunities for error. For those of you whose bank does a manual review – where does that review take place? Is it a back office (deposit operations, fraud control, risk & compliance etc.) or is it done by the branch staff? We looked at both Verafin and Nice Actimize. Wound up going with Verafin. We’re in the early stages of implementation – 1st part is BSA and AML. Check activity comes in phase 2.

-

All of the large dollar review from items coming through in clearing is being reviewed in back office (deposit operations).

-

We have a two-step process. OASIS is the name of the software we use to detect inconsistencies with in-clearing checks. Once an item has been identified, it is reviewed by someone in back office for clearing. Those items that they aren’t able to “clear” right away are the ones we send to the branches for verification with the customers.

-

We use Verafin and have for several years.

-

We utilize Verafin as well and our Compliance team (led by our BSA Officer) reviews all checks, etc. We have only been using the program for a few months, but so far, we are very pleased

Question: 4/4/2024 – Do any of you work with ATM USA currently? If so, I have a couple specific questions I will send you separately.

- Yes (2 responses)

Question: 4/5/2024 – We are updating our Policy/Procedures around Endorsement and I am hoping I can get some input from the group around how your banks handle the following:

- Does your bank accept Special endorsements

- If yes, how do you verify the first endorsement

- If yes do you accept via mobile/RDC

- Response: Third-party checks need management approval, on a case-by-case basis. If approved, the third party needs to be in-person to provide identification and its recorded on the back of the check. The correct endorsement on the back of the check is payee’s signature, written “pay to the order of” and JMB customer’s name depositing check. We don’t cash third-party checks, only deposit, if approved. Best practice-A case-by-case (two day) hold should be placed on these funds. We do not accept this in RDC/Mobile.

- Response: As a norm we do not accept third party checks for deposit, that said, depending on the relationship we may accept smaller dollar checks payable to another person with our client’s endorsement- it is rare and not often.

- Do you accept multiparty checks?

- If so, what are your endorsement requirements

- Both sign?

- Must they sign in person?

- Response: Ideally, we want all payees on the check to be present to endorse the check, and treat it as third party checks above. If some of the payees are not JMB customers and are not present, we can ask that those individual payees take the check to their bank and have their bank “guarantee” their signature using a “Prior Endorsement Guarantee” stamp or PEG stamp. This places the liability for those customer endorsements on the other bank, giving us recourse should that individual or company ever come back and claim that they did not receive said funds from the check.

- If so, what are your endorsement requirements

- Do you allow exceptions for qualified endorsements (i.e.

insurance checks)

- If so do you have require specific language in the endorsement itself

- If so, do you require any special indemnification agreement with the client

- How are these exceptions noted in your policy?

- Response: We do not have specific procedures for qualified endorsements. In the past we have reviewed the endorsement and if signed by the other institution with their endorsement (usually it states “without recourse” signed by a lender, etc.). We follow the same process as above for third party checks. Again, truly depends on a case-by-case basis. There have been times were we ask the customer to refer to the Bank listed on the check and deposit it there.

I know this is a big ask and I really appreciate your all’s input.

Question: 4/12/2024 - We are reviewing our limits for cash and POS for both our consumer and business debit cards. Reaching out to see if you can share your limits.

-

Personal-Cash $750 POS $2,500; Business-Cash $1,000 POS $5,000

-

Consumer: ATM- $550 and POS- $2,500; Business: ATM- $550 and POS- $5,000

-

CONSUMER ATM $500 (DAILY LIMITS) POS $3,000 (DELAYED SETTLEMENT)

KEYSTONE ATM $1,000 (DAILY LIMITS) POS $3,000 (DELAYED SETTLEMENT)

$UCCESS ATM $1,500 (DAILY LIMITS) POS $3,000 (DELAYED SETTLEMENT)

COMMERCIAL ATM $500 (DAILY LIMITS) POS $4,000 (DELAYED SETTLEMENT)

$MART$TART Three tiers available, with one chosen by Joint Owner (Parent/Guardian): Tier 1 ATM $20 (DAILY LIMITS) POS $50 (DELAYED SETTLEMENT) Tier 2 ATM $60 (DAILY LIMITS) POS $100 (DELAYED SETTLEMENT) Tier 3 ATM $100 (DAILY LIMITS) POS $200 (DELAYED SETTLEMENT)

Question: 4/22/2024 - I am curious who you all use as your consumer and business credit card vendor? We are considering making some changes.

-

We are currently using UMB for our consumer and business credit cards (2 responses)

-

Fiserv’s Credit Choice

-

Elan (2 responses)

-

TCM Bank

-

ServisFirst

-

We process in house at [our bank]. We process for about 40 other banks in conjunction with CorServ. I am happy to connect you with our associate here at [our bank] that runs that area and relationship with CorServ if anyone wants more info. I used to run the large relationship we had with Elan, when we were [another bank], but I’m not involved in the day-to-day stuff with it here at [our bank]. I believe Kathleen’s bank is using CorServ as well, based on CorServ’s website.

Question: 5/20/2024 - Reaching out for some information on the following:

- Paper Statement Fee for consumer and business, if

applicable.

Response: We do not have a paper statement fee

Response: We only have two accounts that charge for statements, they are $4 per month if they do not have estatements. - For those of you that have Call Centers or Customer Contact Centers, was hoping to put our Manager, Erin Paich, in touch with your Managers so they could possibly network with each other as this is a unique area of the Bank for many of us and I am sure they may look a little different from Bank to Bank. If this works for you, please send me their contact information and I will share with Erin.

Question: 5/21/2024 - My question is about who communicates with customers regarding BSA issues? When compliance detects that a customer could be violating BSA due to their account activity, do they reach out to the branch/officer for them to have a conversation with the customer, or do they contact the customer directly? The same goes with closing accounts due to account activity; does the branch manager contact the customer and send them the closure letter, or does the correspondence come from the compliance department?

- All client contact comes from branch staff. Our compliance department never speaks with clients. (2 responses)

- Our process is to have the branch contact the customer. (2 responses)

- The branch reaches out to the client and if there is an assigned RM, the RM will reach out.

- BSA reaches out to the Office Leader to have the conversation with the client and to send the letters.

- Our BSA department reaches out for suspected BSA related items, and then informs the branch of how to proceed. If the account needs to be closed, the contact and closure happens in/from the branch.

- Most of the time the communication comes from the Branch Staff. There are occasions the BSA Officer speaks to clients and/or signs letters addressing account issues/closures. (2 responses)

- Our branches do the outreach. We have templated letter for closures.

Question: 7/17/2024 - We are currently evaluating our Medallion signature guarantee program. I am hoping you can help me with the questions below:

- Who is in charge of the administration of the program

(Retail, Trust, etc.….)?

Responses:

-Compliance Department

-Branch Managers and Assistant Managers (bank officer title and up)

-Corporate Services

-Retail Branch Managers

-Ops managed the admin of the program - Do all branches offer this service and have an assigned stamp? What are the stamp limits for the branch?

-

Responses:

-All branches have a specifically assigned stamp, with at least one user registered. Limits are $100k, over that limit, we refer them to our Investment Division.

-Individual employees have an assigned stamp. $2,000,000.

-Select branches – $1,000,000

-Yes, $1mm - If all branches do not offer the service, how is the service

provided?

Responses:

-All branches can offer the service, but we request clients make appointments to ensure someone with the ability is present.

-Typically by appointment so we can assure that we have someone we a stamp available, but we will accept walk-ins if an authorized individual is in the branch at the time - Is there a fee charged for the service?

Responses:

-We do not charge a fee and only offer the service to existing customers. (5 responses) - Do any non-retail employees provide the service?

Responses:

-Investment Division

-This is an expectation in branch banking and is monitored by our Consumer Operation.

-Other Areas of the bank Such as Private Wealth and Trust also have this service.

-Members of Trust and some Commercial Lenders.

-Not at the moment (2 responses)

Question: 9/3/2024 - With fraud on the rise we’re looking at ways to reduce losses and positive pay for consumers seems like a viable idea. Has anyone tried it? I’m sure getting individuals to input check issue files will be challenging but not impossible.

- We have not tried it (2 responses)

- We offer this service for businesses and have been pushing it pretty hard since November of 2022. It has certainly had its challenges, but overall it is going well, and we are signing up new business customers every week. We do not offer it yet for consumers

Question: 10/9/2024 - I am currently conducting some research on cashier’s check fees and would appreciate your response regarding the following:

- Does your bank waive the cashier’s check fee when a client is

closing their account?

- We do not charge a fee when closing an account.

- Waive, we consider these internal transactions

- Yes

- Yes. We do not charge a fee.

- Does your bank waive the cashier’s check fee when a client is

solely a CD client and has no transactional accounts?

- We do not charge a fee for closing a CD.

- Waive, we consider these internal transactions

- It would depend on the circumstance, but yes we could.

- Yes. We do not charge a fee. We would not want a client walking out with that much cash, for several reasons, primarily their safety.

- Does your bank have certain types of accounts that waive the

cashier’s check fee automatically? If so, how many per month?

- We have a few different accounts that offer free cashiers checks included or as an option. There is currently no limit on the number.

- We have a grandfathered account that does get free cashier’s checks (customers over 50) but none of our current checking accounts offer free cashier’s checks. We do waive Cashier’s check fees when they take the funds from a savings account. Limit 3 per month (savings)

- Yes, our Core does not know to auto waive, but we do offer account types with free cashier’s checks; unlimited

- Yes, 3 of our accounts waive the fee (senior, interest and wealth accounts). No limitations.

- When a client is requesting a cashier’s check fee to be

waived and the account does not allow an auto waiver (not a

qualifier), does the associate seek approval from their manager?

If so, what is the process?

- They are to seek approval from manager, either in person or via email, detailing why a waiver should be made.

- We do not do cashiers checks for non-customers outside of that specific process.